MSR Platform

MAM Ecosystem Advantage

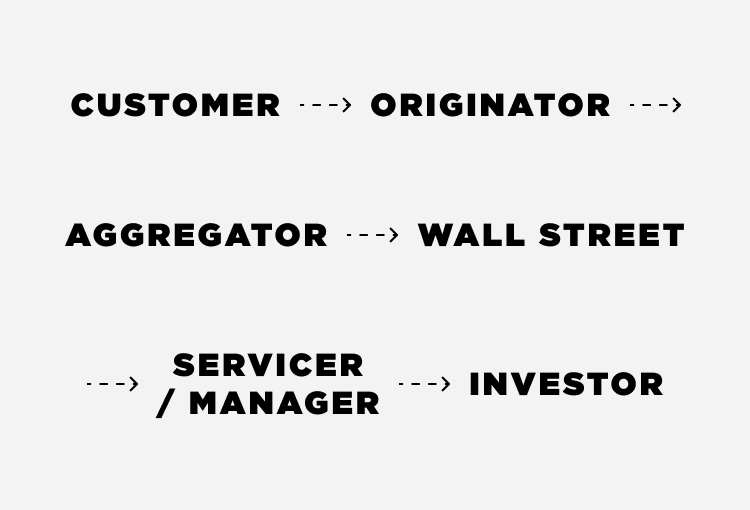

Movement Asset Management, LLC (MAM) was created to serve as a clearing platform (the "PLATFORM") for buying and selling residential Mortgage Servicing Rights (“MSR”). The PLATFORM provides investors with the virtual access to the skills and tools required to own the MSR asset, while minimizing the operational liabilities associated with ownership, control, and regulatory compliance.

- After an inquiry is made from a customer, the structure of the industry does not allow for feedback loops.

- Each touchpoint acts in its own self interest and no consideration for the other stakeholders in the ecosystem.

- MAM is an investor and a customer in addition to being the central neural link that receives and systematically reacts to feedback.

- Direct costs and bulk aggregation of mortgages costs investors 4-8% prior to deployment.

- Lack of selection and bulk packaging costs investors an estimated 5% in return prior to AI driven selection, recapture, refinance and call campaigns.

- Revealing and making available previously captive cash flows to the entire ecosystem.

- This unique position in the ecosystem and AI technology makes active management systematic and in a constant learning mode as feedback points increase.

MAM Structural Alpha

- Sustainable alpha is rare. Structural, regulatory and ecosystem synergies are among the most sustainable and durable.

- Every touch point within the highly specialized mortgage and real estate market process and incentives offers an opportunity to generate sustainable alpha sourced from one of or a combination of the sources above.

- Being aligned and invested alongside investors and borrowers assures conflicts and self interest dealings are eliminated as MAM moves borrower, originator, servicer and investor together.

- MAM’s alignment of interest to investors is matched by its commitment to its borrowers. Being vertical means we continue to service the borrower after origination and beyond.